Neon, a colorless and odorless gas, is typically not as exciting as it sounds, but this unassuming molecule happens to play a critical role in making the tech we use every day. For years, this neon has also mostly come from Ukraine, where just two companies purify enough to produce devices for much of the world, usually with little issue. At least, they did until Russia invaded.

Faced with the devastating reality of war, Ukraine’s neon industry halted production. One of Ukraine’s two primary neon companies, Ingas, is based in Mariupol, which has been repeatedly bombed by Russian forces and is currently under siege. The other company, Cryoin, is based in Odesa, where citizens are currently preparing for an assault. And amid terrifying conditions and a mounting number of civilian casualties, the safety of the people who work at these firms is the priority, not the potential impact on tech manufacturers.

There will be ripple effects, though. Semiconductor manufacturers rely on neon to control the specialized lasers they use to make computer chips. Right now, it’s not clear whether they have enough time to find and develop new sources of this gas before their backup supplies run out: Chip companies and industry analysts say there’s anywhere between one to six months worth of neon in reserve. If that runs out, these companies won’t be able to make semiconductors. This means that the worldwide chip shortage — which was expected to end sometime in the next year or so — could draw out even longer, leading to higher prices, delivery delays, and shortages of critical technology.

“Whether it’s electronics, cars, computers, phones, new airplanes, anything you can think of has a semiconductor chip,” explains Unni Pillai, a professor of nanoengineering at SUNY Polytechnic Institute. “In the long run, if it doesn’t resolve, then you may not be able to buy these products on the market anymore.”

This looming shortage is a grave reminder that technology manufacturing is spread throughout the world and across different companies, some of which are clustered in a single country. Hardware companies like Apple, Samsung, and Intel tend to like this approach because they buy components from specialized third-party manufacturers, which allows them to cut down on labor costs and assemble devices with a high level of efficiency. What the ongoing war in Ukraine makes clear, however, is that this system is also precarious, and that a snag in the production of even the most basic component or ingredient can jeopardize the world’s access to all sorts of tech. Neon is just the latest example, but it’s unlikely to be the last.

The fragile neon supply chain, explained

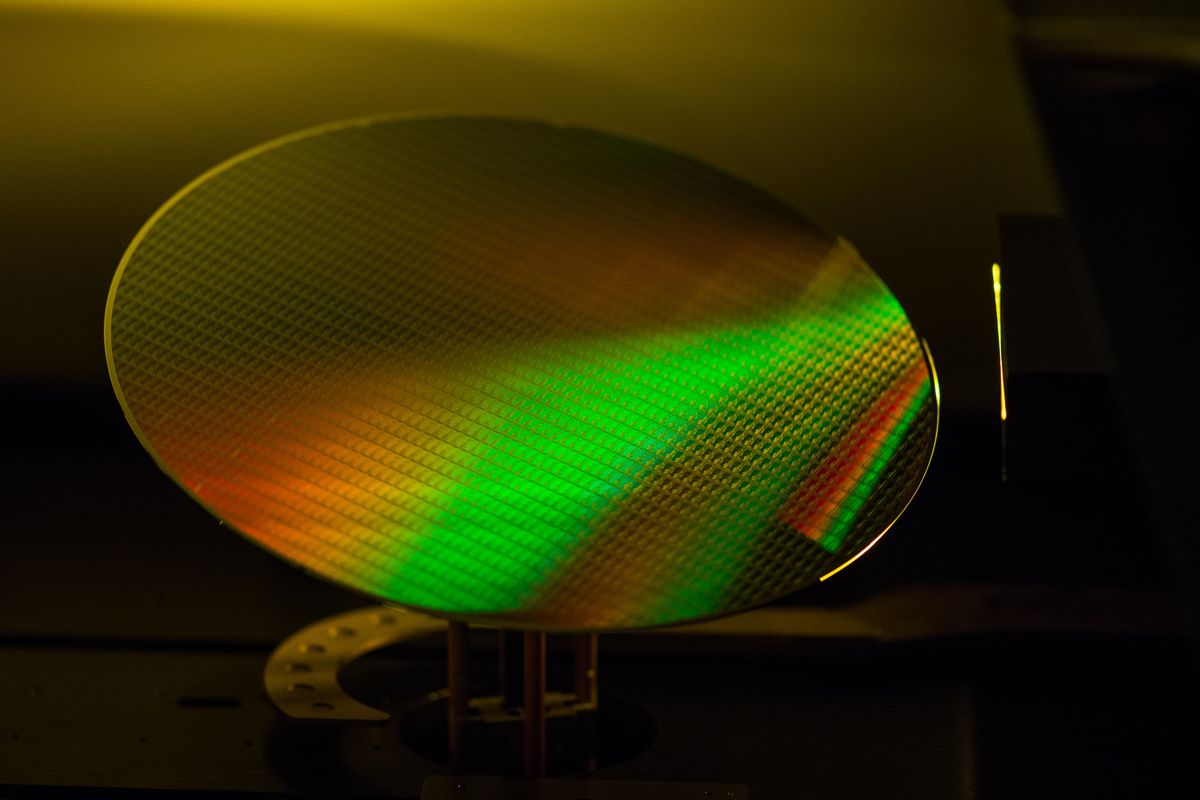

Chip manufacturers generally don’t produce their own neon. Still, they need the gas to operate the highly precise lasers they use to turn silicon — the primary ingredient in chips — into the tiny circuits that make computers work. These lasers play a primary role in a step called lithography, which comes after long silicon cylinders, sometimes called ingots, have been sliced into thin sheets of silicon, which are called wafers and often resemble CD-ROMs. Manufacturers use these lasers to etch tiny, delicate patterns onto the glass, which starts the process of transforming a sheet of silicon into a sheet of chips. Because these chips are so small and intricate, though, manufacturers need to control the exact wavelength of light emitted by their lasers. That’s what neon is for.

Semiconductor manufacturers use lasers to create computer chips.

Nathan Laine/Bloomberg via Getty Images

“Neon is what’s called a buffer gas. You need something that’s kind of inert to play a role in this process of generating the current wavelength of light in the laser,” Pillai told Recode. “That exposure actually creates those electronic circuits.”

Neon itself isn’t so easy to get. The gas is typically captured directly from the air, so manufacturing plants use specialized air separation technology to distill neon into a liquid form, which allows it to be separated from other molecules, like nitrogen and oxygen. Because neon is only a fraction of a percent of the air, it takes a lot of air to produce the amount of neon the semiconductor industry requires. That means that the most convenient place to get neon is usually at a facility that’s already using the same technology for other reasons. These tend to be steel plants, often those in the former Soviet Union.

This basic process captures neon in crude form, but chip companies usually need a more purified version of the gas. That’s where those two Ukrainian companies, Ingas and Cryoin, come in. Together, Ukraine produced around half of the 667 million liters of semiconductor-grade neon that was used last year, according to Techcet, a semiconductor supply chain advisory firm. Cryoin primarily makes neon for the chip industry, but Ingas also makes other kinds of neon, including the kind used in the neon signs you might see in storefronts.

Even before Russia invaded, there was evidence that Ukraine’s supply of neon was vulnerable. When Russia annexed the Crimean peninsula in 2014, the price of neon surged by about 600 percent, and companies started questioning whether Ukraine could reliably produce neon in the long term. There were also signs of trouble in the months and weeks leading up to Russia’s attack. Since December 2021, neon prices have surged in China, which is also home to a number of neon producers. Sensing that Russia would soon invade, in early February, the White House told chipmakers to start looking for sources of neon outside the country. About two weeks later, ASML, one of the chip industry’s primary suppliers of lasers, started looking for new places to buy neon, too.

In response, chip companies stockpiled their neon. At the moment, the Semiconductor Industry Association, the main trade organization representing the US chip industry, has said there won’t be “immediate supply disruption risks” due to the war. It’s also possible that these companies can turn to measures that they also used in the aftermath of the Crimea crisis, like recycling the neon they do have and adjusting their lasers to make their neon last longer. The problem, though, is that these are all just short-term solutions, and it’s not clear how long the war will go on. At some point, the neon could run out.

The chip industry reshuffles

Ukraine’s longtime hold on the neon industry reflects decades of globalization, free trade policies, and even the birth of the modern shipping container, which has allowed companies to move devices at a relatively low cost from factory to factory as they’re being assembled. Through this system, countries across the world have been able to develop their own niches within the broader supply chain, just like Ukraine has done within the semiconductor industry. But this system is extremely risky, especially during a crisis. It can leave workers in dangerous conditions and people without access to critical technology.

Over the past two years, the worldwide semiconductor shortage has made this clear again and again. Covid-19 outbreaks at chip manufacturing plants continue to slow down device production. So have power shortages in China, a fire in Japan, and extreme weather in Texas. Now, automakers are selling cars without parts, and alarm companies are struggling to replace obsolete home health devices and security systems — all because there still aren’t enough chips. In this sense, the war in Ukraine is just another example of how the shortage of an often unnoticed component or ingredient has the capacity to cascade and throw the entire technology industry off course.

“These basic materials — parts of the supply chain — there’s so many tiers down in most supply chains that people don’t think about it,” Willy Shih, a business administration professor at Harvard, told Recode. “That’s a function of the complex web that we have woven over the last couple of decades.”

Countries are racing to backtrack from this approach to making semiconductors. Japan, China, South Korea, and the European Union have all started or plan to invest billions of dollars to develop their own chipmaking capabilities. The US is currently weighing a plan to spend more than $52 billion to boost the American chip industry, which is supposed to jump-start domestic tech manufacturing and make US tech much less dependent on other countries. What the neon shortage has also highlighted, however, is that the chip industry is highly dependent on a wide range of components. If shortages of these components can prolong the chip supply crunch, they’ll certainly hold back the coming chip renaissance.

In January, President Joe Biden spoke about the importance of semiconductors at an event in Washington, DC.

Yuri Gripas/Abaca/Bloomberg via Getty Images

“The change that’s happening right now — to go from a more global economy to a more local economy — this [war] is indeed pushing it in that direction,” Lita Shon-Roy, the president and CEO of Techcet, explained. “Each region will have to put things in place to allow them to be more self-sufficient in terms of materials.”

In the case of neon, this is already happening. Back in 2016, Ukraine produced about 70 percent of the neon used in the world’s semiconductors, according to Techcet. But in the wake of the Crimea crisis, new sources of neon started to pop up. Some US steel manufacturers reconfigured air separation tech they already had so they could capture neon, and one American industrial gas company, Linde, spent $250 million to build a neon production site in Texas. Manufacturers in other countries, including China and South Korea, are also manufacturing their own neon supplies. In response, Ukraine’s share of the neon market has declined.

A solution to the neon shortage won’t be the end of the chip industry’s problems, though. Even if new sources of neon arrive, the ongoing war could still create a shortage of other critical supplies used for chips. Russia makes a large chunk of the US’s supply of palladium, a metal that’s used in semiconductors and catalytic converters. It also provides much of the world’s nickel, a critical material for making electric vehicle batteries, and C4F6, another gas used in chipmaking. At the same time, Mykhailo Fedorov, Ukraine’s minister of digital transformation, is calling on some chip companies, including Qualcomm, to withdraw from Russia entirely.

“When things like this happen, as is happening in Ukraine, it exposes all those connections,” Shih, the Harvard professor, said. “A lot of people are surprised.”

In the future, countries want to be less surprised, which is why they’re throwing a lot of money at developing a more self-sufficient — and more costly — approach. For now, though, the global tech supply chain remains a house of cards. That means manufacturing the chips used to make everything from defibrillators to virtual reality headsets still depends on the world generally being in a good place, one where there aren’t wars or pandemics. Unfortunately, this is not the world we live in.