Digital Transformation of cars is the requirement of the future as there are many industries with more and more semiconductor requirements and it created a global shortage. Perhaps the largest hit industry is automotive. Shortages of semiconductors have been hurting manufacturers of automobiles.

Just as the semiconductor companies like TSMC and Texas Instruments had reallocated their capacity to other companies which are capable of fulfilling large orders. Demand from the auto industry spiked unexpectedly.

Recent earnings of (NXP) explained the situation in the auto industry:

“I think at the moment from anything we can see, the supply chains through the auto world are empty. And I say that because I know that every single product we are shipping is immediately built into a car. And so there is just nothing going on the sideline. It all goes through into production immediately.”

In a long run, we are expecting digital transformation of cars. The usage of silicon will keep on increasing as the cars get smarter.

Deloitte looked at the cost of electronic systems in percentages, it was 5% in 1970, 15% in 1990, 35% in 2010 and is expected to be 50% in 2030.

Post Contents

Why so much supply shortage?

During the pandemic last year, a sudden demand for servers and work from home-related semiconductors increased in march.

Soon the demand for gaming PCs and GPUs spiked as more and more people spending time at home.

This increase in demand hit the automotive supply chain from March to May. Large manufacturers such as TSMC reallocated their capacity to other companies.

But then suddenly something completely out of the blue happened in the fourth quarter: automotive vaulted up again.

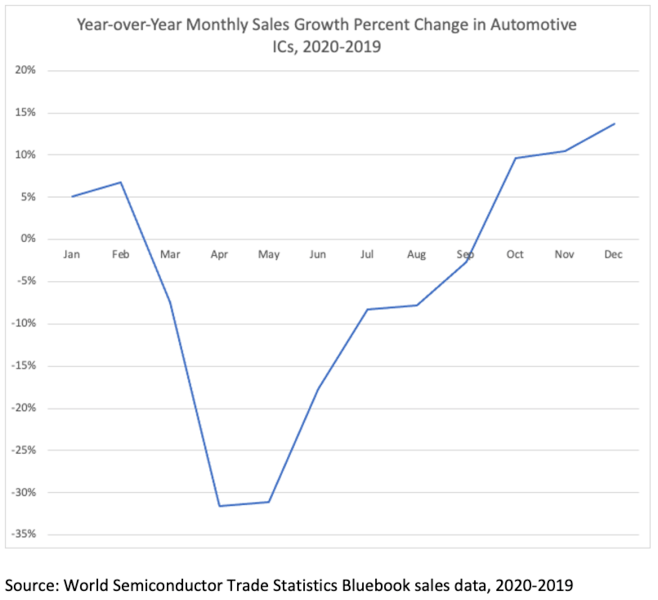

The below chart from SIA shows the real story.

The spike in demand left suppliers offsides. Texas Instruments shared the same stats depicted in the above chart.

And I think the best way to maybe describe what we’re seeing in the automotive market is just a – just-in-time supply chain that’s restarting from essentially a full stop that happened in second quarter. And just as a reminder, what we saw in third quarter was a 75% sequential increase, followed by this last quarter with a 20% sequential increase.

Panic situation during covid

Companies during COVID gathered up together to weather the shocks. The focal point was on drawing down inventory, cash prevention, and staying alive.

After the panic situation ended, they realized that there wasn’t enough capacity for a return to pre-COVID demand.

Greg Kable also tweets on this situation:

The stretched supply chain has actually resulted in less cargo capacity for international flights.

Now 1 last element on this, which everybody tries to understand currently, is about inventory levels. I think at the moment from anything we can see, the supply chains through the auto world are empty. And I say that because I know that every single product we are shipping is immediately built into a car. And so there is just nothing going on the sideline. It all goes through into production immediately. That’s why we also clearly said we are supply constrained for the first quarter.

And as a reaction to this, I hear quite a few people in the industry speaking about the desire to actually ask for more inventory along the chain in automotive going forward. There is 1 large U.S. OEM, which actually made even a public statement about how much chip inventory they would like to see at their first-tier customers.

As we have heard that NXP semiconductors giving a great intuition into the situation and why there is likely no end to this in the short run. There’s almost no spare inventory.

Cars industry needs Transformation

This automotive problem is not the only problem but it goes up to the situation of almost every company fighting for capacity.

There is some kind of capacity problems in notebooks, GPUs, and MLCCs sectors. That’s why we have seen 45% YoY growth at TSMC. Moreover, it is assumed a 20%+ increase in wafer fab equipment (WFE) spending.

There is great demand for items ranging from simple wire-bonding and discrete products all the way to leading-edge wafers.

No doubt it sounds great for these business owners but it will decrease with time. Digital Transformation is the way to move forward.

The usage of silicon in the cars industry has increased as compared to previous years. Most semiconductor companies left behind the actual vehicle end-market in 2020 due to an increase in demand.

For evidence, NXP has transformed its processes which improved its business whereas others saw a decline in auto markets last year.

Apart from Tesla and BMW most of the automotive sector has not begun the digital transformation. They lack smart ideas and innovation. This pandemic has given an opportunity to all the competitors to adopt digital technologies for the improvement of processes and end products.

Potential features in modern cars

We have started hearing about smart driverless vehicles, robotaxis, and many other potential features that can be built into cars. These features can help humans in safety and ease of doing things in daily life.

There are several companies that have tested robotaxi services in Asia and in the United States. Robotaxi can have a very positive impact on human safety, traffic congestion control, and parking. These are also environment friendly since these services will most probably use electric cars.

We hope to see more and more improvement and adoption of digital transformation in the cars sector. It requires learning and adopts the latest technologies.